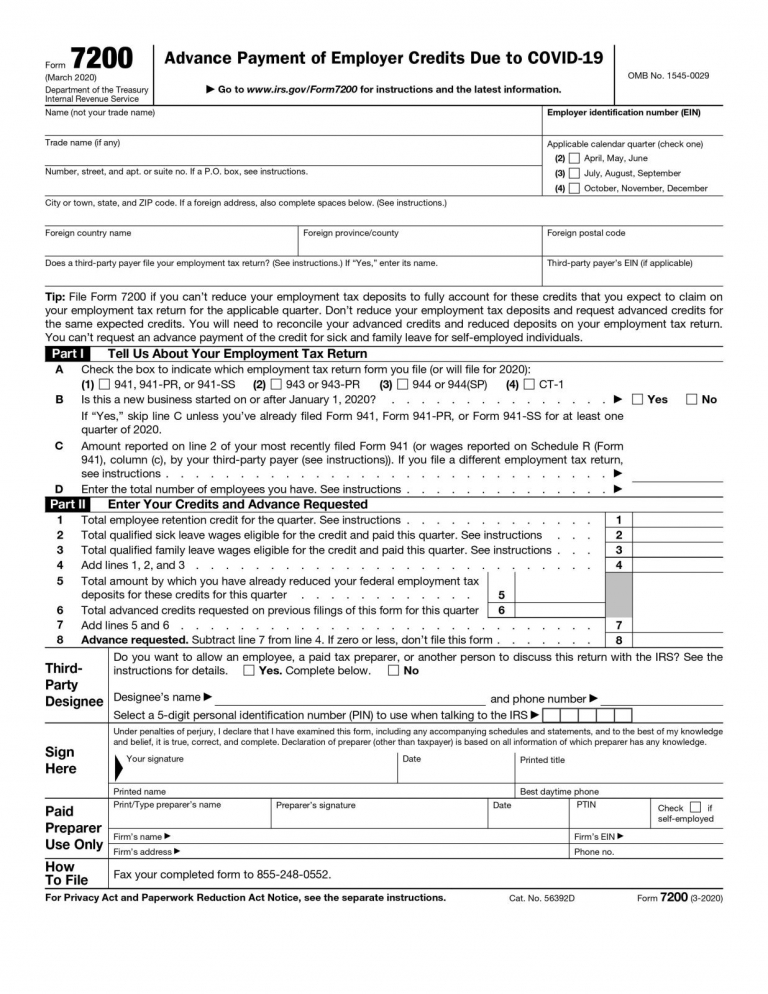

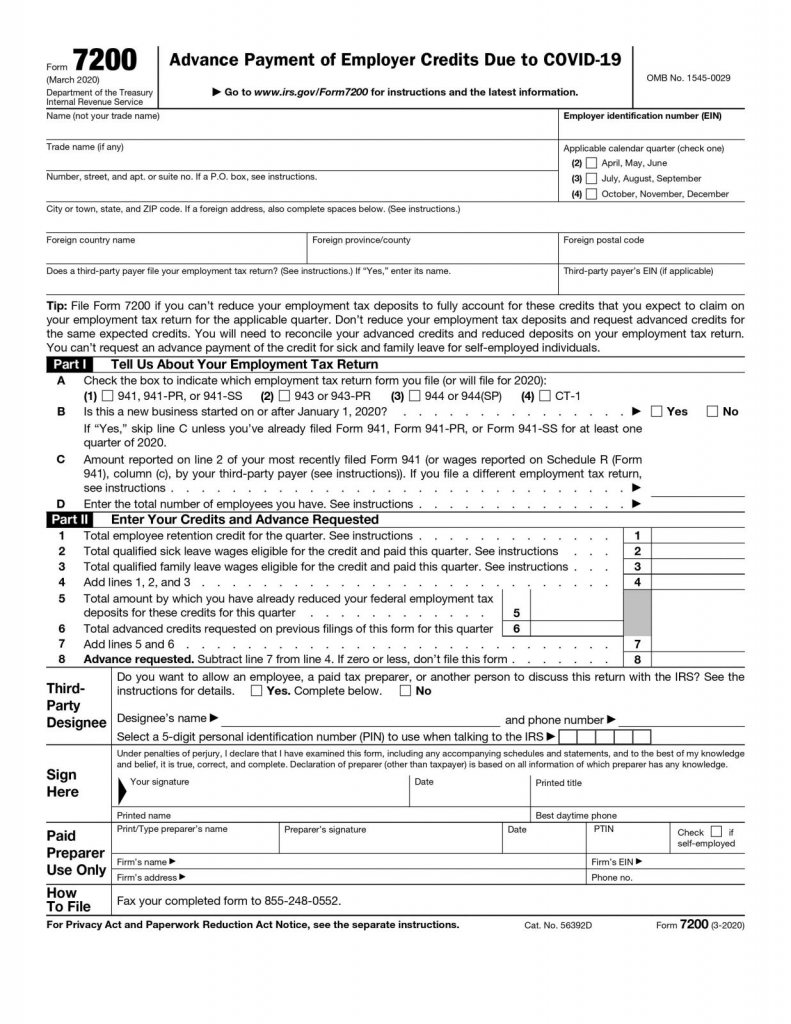

The IRS has issued Form 7200, Advance Payment of Employer Credits Due to COVID-19. Form 7200 will be used to request an advance payment of tax credits for qualified sick and qualified family leave wages and the employee retention credit that will be claimed on the Forms 941, 943, 944 and CT-1.

The Families First Act (FFCRA) requires certain businesses to provide paid leave to certain workers. The costs of providing the required leave can be offset with refundable tax credits against employment tax. Employers will be allowed the full amount of this refundable credit even if it exceeds their employment tax liability. If quarterly employment tax deposits that are otherwise required are less than the amount of credit for which the employer is eligible, the employer may receive the remaining credit in advance, using Form 7200.

Eligible employers entitled to claim these refundable tax credits are businesses and tax-exempt organizations that have fewer than 500 employees and are required to provide qualified sick leave wages and qualified family leave wages under FFCRA. Eligible employers also get credit for the qualified health plan expenses allocated to the qualified leave wages and for the employer’s share of Medicare taxes on the qualified leave wages. Eligible employers will be able to claim these credits based on qualifying leave wages they paid for the period between April 1, 2020, and December 31, 2020.

The CARES Act provides an employee retention credit to certain employers that operate a business during 2020 and retain employees, despite experiencing economic hardship related to COVID-19. Employers who receive a Small Business Interruption Loan under the CARES Act can’t claim the employee retention credit. The refundable tax credit is equal to 50% of qualified wages paid to employees after March 12, 2020, and before January 1, 2021. A maximum of $10,000 in qualified wages for each employee for all calendar quarters may be counted in determining the 50% credit. Employers are eligible for the credit for any quarter in which they have either had to fully or partially suspend operation of business because of governmental orders due to COVID-19, or if they have had more than a 50% decline in gross receipts as compared to the same quarter a year ago. For employers that averaged 100 or fewer full-time employees in 2019, the credit is based on the qualified wages paid to all employees during these periods. For employers that averaged more than 100 full-time employees in 2019, the credit is based on qualified wages paid to those employees not providing services due to the suspension of operations or decline in gross receipts. Qualified wages include qualified health plan expenses allocated to the qualified wages. Qualified wages don’t include wages for which the employer receives a credit for sick or family leave under FFCRA.

When Form 7200 might be applicable. When employers pay their employees, they’re required to withhold federal income tax and the employees’ share of social security and Medicare taxes. Employers are required to deposit these taxes, along with their employer share of social security and Medicare taxes, with the IRS and file employment tax returns (Form(s) 941, 943, 944, or CT-1) with the IRS. Eligible employers who pay qualified sick and family leave wages or qualified wages eligible for the employee retention credit are entitled to retain an amount of the employment taxes equal to the amount of qualified sick and family leave wages (plus certain related health plan expenses and the employer’s share of the Medicare taxes on the qualified leave wages) and their employee retention credit, rather than depositing these amounts with the IRS. The employment taxes that are available to be offset with the credits include withheld federal income tax, the employee share of social security and Medicare taxes, and the employer share of social security and Medicare taxes with respect to all employees. If there aren’t sufficient employment taxes to cover the cost of qualified sick and family leave wages (plus the qualified health expenses and the employer share of Medicare tax on the qualified leave wages) and the employee retention credit, employers can file Form 7200 to request an advance payment from the IRS. Taxpayers must not both reduce their deposits and request advanced credits for the same expected credit. A reconciliation of advanced credits and reduced deposits will need to be done on the taxpayer’s employment tax return.

For example, if an employer is entitled to a credit of $5,000 for qualified sick leave wages, certain related health plan expenses, and the employer’s share of Medicare tax on the leave wages and is otherwise required to deposit $8,000 in employment taxes, the employer could reduce its federal employment tax deposits by $5,000. The employer would only be required to deposit the remaining $3,000 on its next regular deposit date. However, if an employer is entitled to an employee retention credit of $10,000 and was required to deposit $8,000 in employment taxes, the employer could retain the entire $8,000 of taxes (as a portion of the refundable tax credit it is entitled to) and file a request for an advance payment for the remaining $2,000 using Form 7200.

Payroll processing companies will be gearing up to handle these changes in the coming weeks. Here is a link to Form 7200 and a link to the instructions.

ARB is dedicated to updating our clients and community as the legislative implications of the COVID-19 pandemic continue to unfold. For additional information or questions on the Paycheck Protection Program and related matters, contact us today.

by Daniel Doiron, CPA